I think people are aware but there is a chance of losing people's interest with multiple threads. There's even someone on Eye of Dawlish blaming car vandalism on the bedroom tax.

Dawlish Discussion

I think everybody is missing the point, what about the thousands of families living in cramped accomodation that need extra space can it be right that some people can live, fully paid for, in a house that is far to big for them. Can it be right that a family with four children are cramped into two bedrooms whilst a single mother can live in a three bedroom house. Hard decisions have to be made, but they must be made unless we are to allow more of our precious farm land to fall under the house builders. Recently I was helping members of my family look for a house in this area and some of the so called starter homes were nothing but oversized cardboard boxes.

Builders must be set standards by the goverment on the size and quality of affordable housing, because what is being built is tomorrows (and in some cases today's) slums. The starter homes that have been built are fare to small for even a small family .

My parents lived in council housing and after I, the last of their two children, left home the local council suggested (forcefully) to them that they move to smaller property and they did. If it could happen then why can that sort of thing not happen now.

I agree with you Kenny that there is a problem of housing supply vs housing demand not only in the private open market sector but also in the social housing sector.

So if demand outstrips supply then surely more homes (both open market and social housing) need to be built?

I understand there are some two million on housing waiting lists. Some 600,000 people will be affected by the bedroom tax. So, even if all those 600,000 people down sized (and they won't even if they want to because there isn't enough smaller social housing accommodation available) then that would still leave an awful of people on the housing waiting lists.

So, how to resolve the problem? Perhaps by building lots and lots of houses for the social renting sector (as after all it will need to be for the social renting sector as the people on the housing waiting lists, I imagine, are not in a financial position to buy on the open market).

Which, yes, will take up more green fields. And I agree with you Kenny that a lot of what gets built today is incredibly small with miniscule gardens.

Remember that a lot of what was once social housing has been sold off over the past 30 years or so and gone into the owner/occupier or private rented market via Right to Buy.

More houses = farm land being built on.

More houses that are also bigger = more farmland being built on

More houses that are bigger and have decent sized gardens = even more farmland being built on.

I don't want green fields/farmland built on anymore than the next person but........how else is the housing crisis in this country going to be eased if not by building more homes?

From an article in today's online Inside Housing

"The government has introduced a range of housing benefit reforms, including capping payments for tenants in the private rented sector. Next week further changes will come into force, when the social housing under-occupation penalty, or ‘bedroom tax’, begins, and from October housing benefit will start to be paid to tenants rather than direct to landlords.

The committee highlights concerns about direct payments. Ms Hodge said: ‘Experience from the past suggests that stopping direct payments to social landlords will simply lead to an increase in arrears and evictions.

‘At the same time some tenants will face higher rents under the affordable homes programme, which will also increase the housing benefit bill, offsetting some of the savings intended by housing benefit changes.’"

Here is the link to the whole article should you wish to have a read.

http://www.insidehousing.co.uk/tenancies/spending-watchdog-slams-welfare-reforms/6526298.article

BBC News Spotlight programme at 6.30pm today (Tues.) and then at the same time again tomorrow will be looking at the Welfare Cuts and their impact in the south-west.

Why will paying the tenant rather than the Landlord lead to an increase in arrears and evictions?

At the moment social housing tenants who need to claim HB have the HB part of their rent paid directly to their social landlord.

With the advent of the universal credit this will stop (with a few exceptions) so that the HB goes to the tenant who will then have to pass onto their social landlords themselves.

The concern is that rent arrears will rise because money will be even tighter in such households than it is now, and the temptation therefore to spend the HB on things like food, utility bills etc rather than towards the rent might be a temptation many may not be able to resist.

I don't buy that.

What about all the millions of people that have their wages put into their bank accounts and still manage to pay the mortgage, rent, bills?

I'm pretty sure that people know paying rent is an absolute must.

Anyone that is given HB and then spends it on other things only have themselves to blame when they are evicted.

Well, whether you buy it or not Paul, it is likely to happen. The government has been told it is likely to happen. The government has chosen not to listen.

Which brings us to the cost to the public purse of any consequent eviction procedures, court hearings etc and then the cost to the public purse of where those who have been evicted end up living. Unless of course they end up homeless and living on the streets in which case I guess their children will have been taken into care and that will cost the taxpayer how much per child per week?

Shall I feed my kids or pay my rent? What a dilemma. But it is one that many who are social housing tenants will be facing. I am not advocating that people should not pay their rent just saying that some will not and it will cost the public purse to sort out the consequences.

Interesting solution from Frank Fields in yesterday's Independent - block up the spare bedroom. It's what they did to windows 400 years ago when the governement of the day imposed a window tax, interestingly to pay for the Nine Years War.

Social Housing tenants currently have HB paid directly to them unless they opt for it to be paid to their LL.

This came in some time ago and has already led to arrears for a variety of reasons which I won't go into here for fear of being pilloried! Needless to say the situation will worsen.

It has already led to many, if not most, private LLs not taking what they call 'DSS' cases.

It also begs the question: Why do so many social housing tenants on HB elect not to have the money given to them for rent paid directly to their LL?

We agree then that the rent defaulting situation will worsen.

So..........if more social housing tenants default on their rent payments to such an extent that they face eviction where then will they be rehoused? It won't be the private rented sector will it for as you say there are a lot of private sector landlords who say "No DSS" (you can see that expression every week in the property pages of the Gazette).

Here's a link I someone sent to me that I found an interesting read.

http://www.huffingtonpost.co.uk/john-wight/bedroom-tax-them-or-us_b_2969592.html

In Exeter tomorrow

B. I thought two days ago you said you were not posting on here anymore... as we are all small minded people.

I broke my own enforced silence in case some people might have been interested in going

Thats all

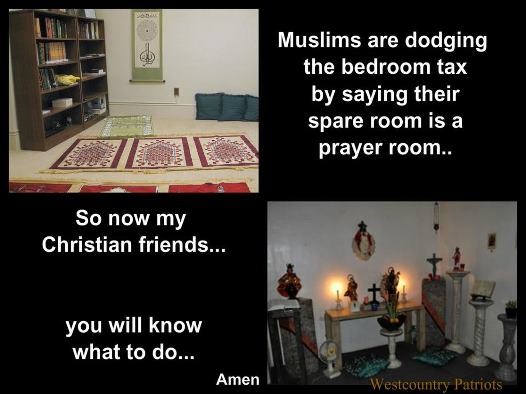

@fredbasset - what an intriguing way to avoid the bedroom tax. I've tried finding out more about your suggestion (ie that places of worship are exempt from the b/t) but can't find anything anywhere.

Can you give me some links please?

Sorry Lynne dont know much about it found the photo on a mates facebook page so dont know if its legit or not. Try Googling the group that posted it ' Westcountry Patriots'

Yeah, I can't find anything more about this either and have to say have never heard about it before your posting above and given as I've been following this bedroom tax business for as long as it was just a glint in IDS's eye it has led me to wondering if this is perhaps just an urban myth being spun for who knows what reasons.

Now, why on earth would anyone wish to do that? eh?

Its false!!! this has been doing the rounds, on some of the FB Pages I go on relating to this tax the admins have looked into it and have stated its not true

A disabled guy from Porthleven has just been on Spotlight talking about his predicament, he now has to find an extra £1000 per year out of his benefits

Report Post

Please Confirm

Details

Please

Please