General Discussion

Wonder how much this policy will aid and abet the breakdown of families and communities?

And whose policy is this? The Tory led government.

And what do the Tories keep banging on about? How important they think families are and how much they think Britain is broken, that's what.

Oh and want to know a further irony? This may not save any money on the national Housing Benefit bill either. In fact it might end up costing the state more.

Here's an example:

Person currently paying £80 rent for a secure tenancy 2 bed house, all rent paid by housing benefit.

Offered a newly built "affordable" tenancy of a 1 bedroom flat by the same housing association at a rent of £100 per week (80% of market rent).

Rent on the previously occupied property goes up to £125 per week as the housing association converts it to a new "affordable" rented property. New tenant moves in and again all rent is paid by housing benefits.

The net effect is therefore that the state ends up paying an extra £65 per week in housing benefit.

Obviously a lot of people who post on here own their own homes, otherwise there would be more of a debate. Is it a case of Im alright jack sod the rest of you

I hope you are wrong B'nut but I am fearful you may be right which is why when I read claims that this policy is the latter day equivalent of Thatcher's Poll Tax and that people will rise up against it en masse like they did against the poll tax I have my doubts.

And I have my doubts because unlike the Poll Tax which affected everyone, this bedroom tax only affects a portion of society. And on top of that, only that part of society living in social housing and who are of working age and who have the whole or part of their rent paid via housing benefit.

Divide and rule - a policy that has always worked and always will.

And don't forget how the poor (both working and non working) have been demonised by this government and the right wing press.

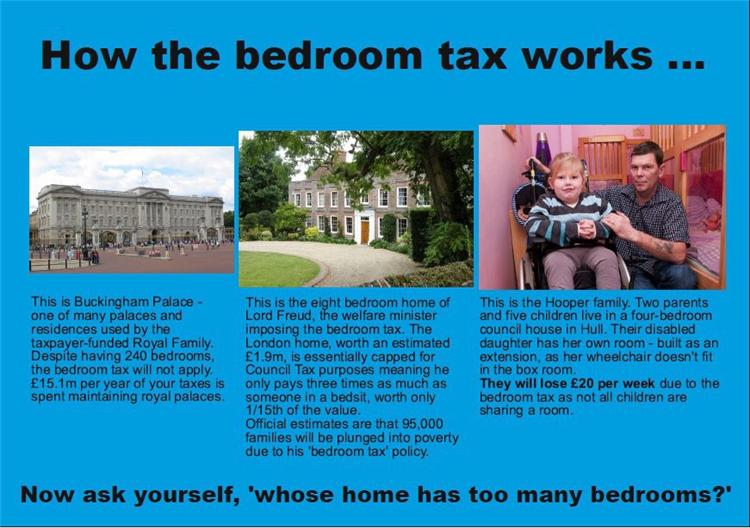

I wrote to our MP about this policy back in April of last year. I got a long letter back via her from Lord Freud justifying this policy. I'll see if I can find it and if so I'll post the relevant bits of it on here.

Yes do that please Lynne and sadly I feel you are right. At the moment it only affects tenants like me but how long before it goes across the board, to private tenants as well, because as you so rightly say those rents are higher. I also think people have not read this properly and think Ive got 2 children a boy and girl so need 3bedrooms but have not realised the rules on ages have changed

I would imagine all those who will be directly impacted by this policy which comes into effect I believe on 1st April (sick joke or wot?) will have now been informed by their social housing provider. So even though the rules on ages for boys and girls sharing bedrooms etc may have changed all those tenants affected should know about it by now.

On a personal note, and from what I have gleaned about you over the years from your postings on here, it seems you are a woman who is already of state pension age. In which case you, personally, are not included in this policy (those of state pension age are exempt) although I appreciate you may well have younger family who will be affected.

Private sector tenants I understand already only get housing benefit or local housing allowance or whatever it is now called according to how many bedrooms it is deemed they need.

This policy (the 'bedroom tax') in determining how many bedrooms any particular social tenant is deemed to need, aims to bring social tenants in line with private sector tenants.

yes you are correct in that assumption of me, but my partner is younger and I have a son living at home. It will affect other members of my family tho, and friends. I just think its henious of this government to impose another tax on top of all the other measures they have brought in. I think the media highlighting the scroungers who are a minority has done nothing to help with peoples perception of living on the state. Ive just watched saints and scroungers on bbc and they highlighted a case of a woman from Africa that had milked this country of £500,000 since 1994, when she was refused asylum, with her different aliases she systematically robbed us. Punishment 28months in prison and to be deported. why was she not simply deported not to stay and get even more from us whilst in prison!!!! money unrecoverable

Another link from Inside Housing that makes for an 'interesting' read (especially the comments posted at the bottom of the article)

http://www.insidehousing.co.uk/tenancies/people-should-work-more-to-pay-bedroom-tax/6525693.article

Just been going through all my paperwork on this matter (and yes I've found the Lord Freud letter which I'll post on here later). Found this letter that I had published in "Inside Housing" last May.

Thank you Inside Housing for your coverage of the ‘bedroom tax’ and its impact on rural social housing tenants. When it comes into effect from 1st April 2013 I fear it will prove sick April Fool’s joke for many in the social housing community.

Although your article “The Downsizing Dilemma” did not cover Somerset, Devon and Cornwall I do not doubt for one moment that the issues raised also apply to rural social housing tenants living here, in the even more remote south-west.

Could this aspect of the Welfare Reform Act be yet another piece of non thought through legislation? Surely it is obvious that if a community is rural then by definition it is not a large settlement and some distance from other settlements.

So just where are under-occupying rural social housing tenants supposed to relocate and how far away from where they presently live? If they are in work locally it may be a close call between staying put and paying the shortfall in their housing benefit or moving away and incurring even greater travelling costs. Perhaps it might even be the case that to move away and give up the job might be the best option open to them. How can such an outcome possibly aid the reduction in the amount of housing and welfare benefits being paid out?

Oh and let’s not forget that if people do move they might well face an increase in rent and thus housing benefit as they will have given up a social rent for an "affordable" one. And, of course, an "affordable" rent could be payable by whoever it is who moved into the accommodation they have given up which in turn could mean even more housing benefit being paid out.

Is it only me that can see a potential huge irony here or is it really the case that by causing people to downsize the state could end up paying out more in benefits? And if so, does it follow that the only way the state can ultimately pay out less benefits is if under-occupying tenants stay put and take the financial hit themselves?

I only worked in social housing for a relatively short period and that was some years ago so I am taking a layperson’s look at all of this. But surely if I, a non professional housing person, can see and work out the impact of the ‘bedroom tax’ on rural communities why is it that Westminster politicians and Whitehall civil servants cannot? Or is it the case that the politicians were told but that they chose not to listen preferring instead to obey the whips and follow their party line.

If you have not already done so please can I urge all to lobby MPs about this matter (especially if the MPs concerned represent rural communities) and make sure that they understand what will happen when this piece of legislation comes into force. Raise the matter in the local press and make your local tv stations aware of it. With all the furore that other aspects of the Welfare Reform Act attracted it seems to me that this particular aspect didn't register on the radar of the wider media. Let's change that.

Hear,Hear Lynne my sentiments exactly. Ill thought out piece of legislation as you said previously to divide and rule

i think this is the most ridiculous and vile act....since our shiny new government got into power, this will litraly destroy families and cocomunitties, lets say a couple sadly split up but do the decent thing and stay amicable for the kids...so 2 homes are needed..both with at least 2 bedrooms to allow the child overnight stays with both parents...as the law states at a certain age they can no longer sleep in a single parents room?? i understand the big picture behind this....to push old couples in 2-4 bedroom properties rented from local authorities to "downsize" however this blanket announcement is too ridiculous and sickening for words..whatever happened to judging each case individualy??? sigh

part of this act no longer take what you are saying into consideration, the parent that does not have the child(ren) will not be afforded the luxury of a bedroom for them

Lynne, your example above does not take into account that 2 people (or pos' 3) are now housed. Nor does it take into account what is being clawed back in unfair and unreasonable Council Tax reassessments and new 'rules'.

And the latter, I assure you, does not just include working age people!

Huw, if this policy is intended to free up underoccupied social housing then why is it only being applied to those of working age who claim housing benefit? Why not apply it also to those social tenants of working age who pay their rent in full but who are also underoccupying? Why not those who are underoccupying and who are of state pension age? Plenty of underoccupancy there I would imagine. (and no, I am not, definitely not, advocating that last scenario before anyone jumps at me. Just querying what this policy is really all about that's all.)

I cannot for the life of me see how people having to move out of their homes, or pay up, when underoccupancy occurs (but only if they are of working age and claiming HB) will lead to stable communities and families. I am also dubious about the cost effectiveness of all of this. And it's not only me who thinks that way - plenty of housing professionals think that way to.

Perhaps we have a shortage of social housing? Wonder what impact the Right to Buy policy has had on the amount social housing stock available for rent? I'll check, but I'm pretty certain that the 'affordable' housing being provided on the two new estates presently being built at Secmaton Lane/Carhaix are two and three bedroomed dwellings. If that's correct perhaps someone somewhere with far more clout than me and thee should ask the builders/social housing providers for some one bed accommodation to be built. Then those who are forced to move out of their homes will have somewhere to be rehoused.

(Huw, can you give examples of the Council Tax reassessments and the new rules please. (on a new thread perhaps?))

I'll do it here Lynne.

Brook House, Dawlish - Sheltered Housing Complex - Average age 86. Been in existence 50 years and since Council Tax came in has been banded at Band H (currently £3150 p.a.) shared between the residents. Reassessment just carried out by VOA at request of TDC. From 1 April 13 the Council Tax will increase to some £22000 p.a. by grading each unit at Band A. In effect an increase from £150 per year each resident to £1055! There will of course be some relief under the new CT support scheme but we don't know the levels yet. Right of Appeal? None!!!

Additionally, from the same date, a new rule will come into being whereby a Housing Association (that is not a charity) will have one month from when a property becomes empty to putting in a new tenant or Council Tax will be charged to the HA. That is fine for the big ones with their own maintenance teams and the clout to demand attendance by tradesmen at short notice but what about the small, not for profit, volunteer run schemes?

In essence they will have the choice of re-letting a property with less maintenance and reinstatement than previously (and bear in mind the essential need to let at Decent Homes Standard) or be punished. And who pays the punishment element of the Council Tax? Well there is only one source of income and that is the rentals so it goes back onto the residents/tenants.

Locally, this has resulted in the ridiculous situation where Teign Housing (a registered charity, large HA with all of the associated maint' teams and tradesmen on call) for example will have 6 months to turn around a property whereas the small providers (who are not registered charities and with perhaps 1 employed maintenance worker) will have 1 month.

Democracy? Where?

Interesting posts = Brook House, maybe the local residents could appeal and ask this amount be back dated

Question why was this situation overlooked.

Another point, a social housing provider or housing association has to be of charitable status in order to provide social housing.

Andy

There is no right of appeal.

An RSL/HA does not have to have charitable status to provide social housing. However all HAs are non-profit making orgs.

Two Days and no comments on increasing Council Tax from £3150 to £22000 overnight to 21 people (many over 90) whose average age is 86!

As I suspected: "It doesn't affect me so stuff it; pull the ladder up Jack!".

This is why they get away with all of it!!!!!

Wake up!

It is appalling Huw - I agree. I cannot speak for anyone else but lack of comments from me weren't due to lack of concern. So many of us are already fighting on so many different fronts at the moment.

Having old people being on the wrong end of economic/welfare cuts isn't politically savvy (putting aside for one moment any moral aspects). Have you/other organisations in this predicament gone public about all this? (and I don't mean on here but with the press/tv?). What has our MP to say about it? There are county council elections coming up in May perhaps our local candidates might have something to say about this issue? Who made this decision at TDC and why? Can you do a letter to the Gazette explaining how this policy will affect residents in Dawlish? And/or a letter to Inside Housing perhaps? They covered this issue a few weeks back http://www.insidehousing.co.uk/home/blogs/no-quick-fix/6525520.article

Is this the policy? http://www.teignbridge.gov.uk/index.aspx?articleid=16889

its the same people commenting on here all the time, I do wonder myself sometimes about the apathy everywhere in society, nobody seems to care unless it affects them, bit like the Government really

"nobody seems to care unless it affects them, bit like the Government really".

I'm tempted to agree with that.

What do all political parties care about? Gaining power and keeping it, that's what.

So, if those who are in the habit of voting Conservative or Lib Dem in this part of the world start making it very clear that those votes may not be cast in either of those directions come the next general election in 2015, then perhaps those two political parties (who are our present government) might start to take some notice about the impact their policies are having on some of their voters and what the consequences might be in terms of parliamentary seats come 2015.

https://www.youtube.com/user/HelenGoodmanMP?feature=watch

heres one MP who is not suffering with apathy!!!

P'raps you should send that link to our MP and suggest she tries doing the same as Helen Goodman!

People who receive Housing Benefit have this limited so are expected to find accomodation within this price bracket or pay the difference themselves if they want a larger property. This so called tax, addresses that imbalance.

EG a person receiving HB, depending where they live, will be allowed a certain amount of money, a couple will receive more money than a single person as they would probably need a larger property.

It is wrong that Council Tenants get their rent paid in full regardless of the size of property they occupy, whereas people receiving HB as I have explained above have to find a property that fits their HB or pay the difference themselves if they want a bigger place.

This so called bedroom tax is an excellent piece of legislation and will free up many multi bedroom properties that are being occupied by a single person.

I know two single people who are affected by this, one of them has opted to pay the extra to stay in his 2 bed flat and the other person now rents a room to cover the increased rent, neither of them feels this is unfair, they could have moved to a single bed flat if they wanted, in which case their rent would have been paid in full.

Sorry Lynne but the way I see it is that young or old if you have to rely on the benifit system to provide a roof over your head, feed you, look after your kids or what ever else. Then someone else is paying for your lifestyle and for that you should be gratefull. In many countries around the world you wouldnt have this luxury, so ask yourself what would I do then?

HB and LHA are 2 seperate things. Not everybody who needs help from these benefits are not working. Some people work but because they are on low income and have dependants require help to pay their rent. A single person will get £98 per week LHA if they live in private accomodation, so they have to find somewhere that comes within that criteria or pay the extra themselves,that equates to £424.66 per month and believe me its not easy to find 1 bedroomed accomodation in this area that low.

Landlords are not keen to have anybody claiming benefits

People on benefits usually do not pass reference and credit checks which is the criteria for most letting agencies and it is also very difficult for people on low incomes as well

This latest henious move is aimed at social tenants it has nothing to do with freeing up larger properties as there is a sever shortage of smaller properties to move into, they qualify for HB and under the new rules will have to pay 14% of their rent themselves for 1 spare room or 25% for more

Contrary to what the media spouts not all benefit claimants are scrougers (a small minority are I agree) and if you are in a 2bedroomed council/HA property and their is no smaller property for you to move to out of £71 you have to foot the extra rent, pay for your energy supply, water rates and feed and cloth yourself, I cannot belief that people refuse to look for work and prefer to claim benefits.

What if through no fault of your own you are made redundant/lose your good health/become disabled there is no discrimination with this "TAX" it affects all

So get off your bloody high horse and research the full implications of this legislation like I have , there but for the grace of god go you or I

and no it will not affect me at the moment but could in the future

Condems might as well put all the elderly/,poor in workhouses again so the European Migrants can have our homes

I have never felt so strongly about a subject that is affecting the whole wellbeing of our Society as we know it

Also if a social tenant moved into a smaller property in the private sector if they were lucky enough to qualify for them more benefit would be payed towards the rent as its higher

'Also if a social tenant moved into a smaller property in the private sector if they were lucky enough to qualify for them more benefit would be payed towards the rent as its higher'

This comment is completely wrong because people do not understand how Housing Benefit (HB) is calculated, housing benefit is now called LHA (Local Housing Allowance)by most local authorities. Let me give you a pratical example of 2 people I personally know as one is a relative of mine.

Both pensioners, in the area they live in the LHA for a single person is £495, so that is the maximum LHA/HB that will be paid for someone who qualifies. This is adequate for 1 bed flat in that area and that is what she rents from a private landlord, her rent is £470, so her rent is paid in full as is her council tax.

The other lady has lived in a Council House for many years and her family have all moved on, she lives on her own in a 3 bed semi detached council house with a large garden, I'm guessing the rental would be £650 a month but she pays no rent as it is council housing so as a long standing tenant she pays nothing towards this.

Now a family of 4 would be allowed HB of £650 pm so they could live in the house and pay no rent and the present tenant could be moved to a 1 bed flat and also pay no rent.

I am sure there are many, many families who are living in small flats who would love to have a 3 bed house to live in.

What the local councils are saying is if you want the taxpayer to pay your rent you are given a an amount that is adequate to rent property to suit your needs, if you wish to live in a larger property then you have to contribute to the rent. We'd all like to live in exclusive expensive suburbs but we have to live in a place we can afford, that applies to buyers and renters. Why should this not apply to people who are having their rent paid by the taxpayer.

Most people getting LHA are PRIVATE renters and not in social housing, and 70% are working people.

Right if you live in a Council/Housing Association and are on benefit you get HB and your rent is paid for you, if you only qualify for part HB you have to make up the shortfall..If you rent private you get LHA which is paid to you to give to your landlord, the amounts vary according to which area you live, here in Teignbridge its £98 for a single person (I know this because my son is in receipt of it ) he only gets a portion of his rent paid as he does work

So to return to my point

If a single person is in a 2bedroom Council house and cant afford to cover the 14% they could move into the private sector and rent a 1bedroomed property

The rent in the 2bedroomed council house is say £80 per week = £346.66 per month

The rent in the 1 bedroomed property is say £450 per monthand now will not fall foul of the bedroom tax and will be entitled to the full amount of LHA but will still see that person having to pay £25.50 per month out of their other benefits. So how is Cameron saving money DWP was only paying £346.66 per month and is now having to pay £424.66 per month

I think Lynne may be able to explain this better

.

Well, I'll try.

There is also another financial aspect to all this moving around of tenants which I've referred to before in earlier postings and which is this.

Not only are private sector rents (market rents) higher than those in the social housing sector (as B'nut points out above) but within the social sector itself there is a variation between 'affordable rents' which are 80% of the private sector market rent and what I will call social rents which I believe are about 60% of private sector market rents.

Thus, if a tenant claiming HB moves out of a 60% rent property into a smaller private sector rented property and claims LHA then that LHA may be more than the HB that tenant was claiming on 60% social rent.

If a tenant claiming HB moves out of a 60% (of market rent) social rent property into a smaller 80% 'affordable' rent property then the amount of HB being claimed will increase.

(Note: I understand there to be a huge shortage of one bed properties in the social/affordable sector so it is more likely that the tenant would end up in the private sector.)

In the meantime the HA that owns what was the 60% of market rent property changes the type of tenure to that of affordable rent ie 80% of market rent. The new tenant claims HB.

Ergo, the amount of money being spent on HB/LHA has increased.

(and on a very personal note I have no problem whatsover with taxes being used to help pay other peoples' rent within the social housing sector but I am damned if I am happy about private sector landlords benefiting from tax payers money).

And I do wonder why, if this 'bedroom tax' is the panacea to the housing problem that some claim it to be, that many others, who are housing professionals, see not only many social problems that this will cause but also an increase in the amount of HB/LHA that will end up being paid out.

Just taken a look at today's Gazette and the property available for rent. I've looked for one bed or smaller. This is what I found.

Dawlish; 1 bed part furnished cottage. £565 per month

Dawlish: 1 bed flat. £450 per month. No DSS/Smokers/Pets

Teignmouth: Studio flat. £320 per month. No DSS/Smokers/Pets

Teignmouth: Unfurnished bedsitting room. £340 per month. No DSS/Smokers/Pets

My son has been trying to get a 1bedroom flat,

a cant afford deposit and agents feea

b wont pass the credit checks and references

c gets an element of LHA

Not so simple wriggler

We may be missing the point here - and for once the aim of the policy is not just to save money.

There is a housing shortage in this country - which could or could not be alleviated by bringing on line empty properties but that is another matter.

To the example above:

"Thus, if a tenant claiming HB moves out of a 60% rent property into a smaller private sector rented property and claims LHA then that LHA may be more than the HB that tenant was claiming on 60% social rent.

If a tenant claiming HB moves out of a 60% (of market rent) social rent property into a smaller 80% 'affordable' rent property then the amount of HB being claimed will increase."

In both cases a larger property becomes available and more people can be housed.

Additionally, as an HA worker we predicted that there would be serious ramifications following the rule change which did not allow private landlords to demand that HB was paid directly to them. I think that this has happened and is borne out by the adverts that Lynne has provided wherein 75% of those LLs do not allow people receiving HB/LHA (eg. No DSS) i.e.:

"Dawlish; 1 bed part furnished cottage. £565 per month

Dawlish: 1 bed flat. £450 per month. No DSS/Smokers/Pets

Teignmouth: Studio flat. £320 per month. No DSS/Smokers/Pets

Teignmouth: Unfurnished bedsitting room. £340 per month. No DSS/Smokers/Pets"

Whether the policy is right or wrong on an ethical level (i.e. people must be able to take responsibility themselves) do you think that this has contributed to the current housing problem, particularly for younger people? And should it be reversed?

And come the advent of the Universal Credit system (later this year I believe) the vast majority of social housing tenants will also be receiving their housing benefit direct for them to pass on themselves to their housing provider. Not surprisingly many who work in the social housing sector are anticipating a huge rise in rent arrears just as Huw has pointed out has happened in the private sector.

And have the government been told about this? Yes of course it has. But has it listened? I'll give you a clue - the answer contains two letters.

Still, with all these social housing sector tenants defaulting on their rent payments, the courts will be busy deciding whether the ensuing evictions are legal or not and whether the tenants made themselves intentionally homeless or not. And whether intentionally homeless or unintentionally homeless they'll still have to be rehoused, by someone, somewhere.

But hey! Look at all that social sector housing that will be freed up. Perfect for er......... homeless families to be rehoused into.

And the cost to the taxpayer of all this will be?

http://www.insidehousing.co.uk/home/blogs/bedtime-stories/6525834.blog

http://www.afteratos.com/?p=3033

Not a result of this tax I know but how long before this happens to the many disabled and terminally ill people it will affect!!!http://ilegal.org.uk/thread/7207/leaked-letter-dwp-saying

and heres another bit of staggering info

@Brazilnut. Ian duncan smith has said today that he has asked officials to look again at the new regulations concerning disabled people.

Which begs the question why didn't he do that some 12/18 months or so ago when this legislation was still going through parliament and yet to be made the law? The government was told then what the affect(s) would be. Did they listen? No.

I await with interest to see what happens but they had better get a move on as this policy is due to be implemented on 1st April. That's about in 5 weeks time.

(Seems they're having a bit of a rethink about pensioners 'n all. http://www.insidehousing.co.uk/tenancies/government-backtracks-on-pensioner-bedroom-tax/6525843.article)

Despite the BBC news feature a couple of days back about the bedroom tax and the DWP looking again at its impact on those with disabilities, it now seems there's to be no change after all.

http://www.insidehousing.co.uk/tenancies/dwp-rules-out-changes-to-bedroom-tax/6525867.article

The government estimates that disabled people make up 420,000 of the 660,000 who will be hit by this policy.

And here is coverage from Skynews http://news.sky.com/story/1055839/bedroom-tax-to-hit-thousands-of-families

Define 'disabled'.

I would argue that those living alone and in fear of venturing outside of their homes (perhaps irrationally but nevertheless real to them) are 'disabled'.

That will bring a lot more people into the frame of 'disadvantaged' by these policies.

Just come across this letter that someone has sent to their MP. Have a read.

http://ktarcus.hubpages.com/hub/Letter-to-a-politician-LibDem-in-particular-BEDROOMTAX

I sat and watched this yesterday on 81 freeview and wsa astounded by the lack of Condems in the chamber yet they all came out of the woodwork to vote, on something they did not even listen to. As for IDS he actions in the House were abomidable total lack of interest!!!!

Dear MPs,

When you sat in the house of commons and voted for the bedroom tax bill:

Did you understand from your own statistics that 85% of under occupancy is actually with Owner occupiers and therefore exempt from the bedroom tax?

Did you understand that there is only a 1...2.9% under occupancy within local authority and housing association properties and the majority of those are pensioners and so exempt ?

Did you understand that Housing benefit for social housing is different altogether that Local Housing Award for Private rental and that the comparison between will never be the same in occupancy or monetary standards?

Did you understand that it will cost borough councils £5 million in administration fees through applications for discretionary household payments alone?

Did you understand that only 3% of the welfare budget actually goes on those in receipt of Jobseekers Allowance, the rest goes on those unable to work through illness and disability, single parents and pensioners AND those already in work on very low incomes with little ability to get more wages or hours due to the employers?

Did you understand that those on receipt on benefits do not live on more money that those who are working. The money they have to live on is £71 per week for Jobseekers, employment and support allowance various amounts under £150 for the disabled and their carers per week. The rest goes to greedy landlords?

Did you consider when voting for this bill that it would be better to tackle the high prices private landlords charge. Tackle banking and lenders so that people were able to buy rather than rent. Tackle the infrastructure to get businesses running through lowering business taxes, business rates on properties so that they can actually employ more people with a better wage which will lead to more spending on the high street?

Did you know that it is estimated that 10 - 30% of the 40% under occupying by one bedroom will need to move into private accommodation because of the lack of one bedroomed social housing availability?. This will cost more in housing benefit whilst on benefits and also cause a reliability on housing benefit when back to work through low incomes?

Did you understand that whilst 10 - 30% of households in household under occupying by one bedroom will be forced to move into private accommodation only 10 - 30% of households with two or more rooms under occupied will in fact move. That will mean 90% - 70% of families who need two or more bedrooms will have to remain in private accommodation and to add to this 10 - 30% of households under occupying by one bedroom will join them?

As a person who has just had a spinal operation and in receipt of Employment and Support allowance rate of £71 per week, I have to find £19.40 shortfall in housing benefit out of this that will be against the law you passed that stated by law that is the amount I need to live on.

I am unable to find the shortfall by taking more hours or getting a job. I am unable to get a lodger due to restrictions set by my landlord.

I run a self employed business in my local area, which I started after a year of being on Jobseeker allowance. I am educated to degree level and 46 years old with history of spine and mental health problems. The job centre did offer advice on taking a sex phone line operator job, which I politely declined.

I will loose my business if I have to move and have to go back on jobseekers for however long it takes to get employed or start a new business if I have to move.

This is false economy, especially as I will probably have to move to a private accommodation at a considerable higher rate than a present.

When I do find a job or start a new business I will no doubt have to remain dependant on housing benefit to help fund the new higher rate private rent.

I wonder when you were sitting voting for welfare cuts and the bedroom tax that it is inhumane, unjust, unworkable and false economy that will cause more problems than what it will solve?

Your sincerely

Miss Dawn Tibble

I received this reply almost immediately from Guto Bebb on his Samsung Phone.

From: guto.bebb.mp@parliament.uk<mailto:guto.bebb.mp@parliament.uk>

To: >

Subject: Re: Parliamentary matters 27th February 2013

Date: Tue, 26 Feb 2013 18:18:11 +0000

Dear Ms Tibble,

An owner occupier does not get taxpayer funds to pay for any extra rooms. As such your argument is rather silly.

Yours sincerely,

Guto Bebb

Sent from Samsung Mobile

I replied to Mr Bebb

Dear Guto Bebb

According to government statistics 80% of owner occupiers in receipt of housing benefit are under occupying, but are exempt by your rules. Therefore my arguments are valid. Please do your homework.

Many thanks

Dawn Tibble

His reply:

From: guto.bebb.mp@parliament.uk<mailto:guto.bebb.mp@parliament.uk>

To:

Subject: RE: Parliamentary matters 27th February 2013

Date: Tue, 26 Feb 2013 18:35:15 +0000

Dear Ms Tibble,

Please explain why an owner occupier receives support with rent.

Yours,

Guto Bebb

Sent from Samsung Mobile

My reply:

:

Sent: 26 February 2013 18:40

To: BEBB, Guto

Subject: RE: Parliamentary matters 27th February 2013

Dear Guto Bebb

An owner occupier will be in receipt of housing benefits if they are not working, disabled or ill. Do you actually believe that everyone who owns their own home are in work?

I have gathered this information from DWP who has clearly stated this fact.

best wishes

Dawn Tibble

His reply:

From: guto.bebb.mp@parliament.uk<mailto:guto.bebb.mp@parliament.uk>

To:

Subject: RE: Parliamentary matters 27th February 2013

Date: Tue, 26 Feb 2013 18:41:14 +0000

Dear Dawn,

If you own your home you have no rent so your point?

Guto Bebb

Member of Parliament for Aberconwy / Aelod Seneddol Aberconwy

guto.bebb.mp@parliament.uk<mailto:guto.bebb.mp@parliament.uk>

My reply:

From:

Sent: 26 February 2013 18:48

To: BEBB, Guto

Subject: RE: Parliamentary matters 27th February 2013

Dear Guto

They are still claiming Housing benefit. That is the point. The point that your government is cutting housing benefit for those under occupying in the social and council housing sector only. But 80% of those under occupying actually are owner occupiers and so exempt from the cut in housing benefit. That is the point.

Do you not see this?

Dawn Tibble.

His reply:

From: guto.bebb.mp@parliament.uk<mailto:guto.bebb.mp@parliament.uk>

To:

Subject: RE: Parliamentary matters 27th February 2013

Date: Tue, 26 Feb 2013 18:54:13 +0000

Dear Dawn,

You are wrong;

Housing Benefit is a benefit for people on a low income to help them pay their rent. You may be able to get Housing Benefit if you are on other benefits, work part-time or work full-time on a low income. You cannot get Housing Benefit to help with the costs of a mortgage or home loan. If you are an owner-occupier, you may be able to get help with your mortgage interest through Income Support, income-based Jobseeker’s Allowance, income-related Employment and Support Allowance (ESA) or Pension Credit.

Owner occupiers cannot receive HB so your claims are rather silly as I said. In the same way the under occupancy rules have applied to those renting from private landlords for years with no complaints from you or others who are now complaining. Whilst the changes are difficult they simply provide a level playing field for those renting privately and there is no issue in terms of excluding owner occupiers as you claim since you cannot be excluded from a benefit that you dot qualify for.

Guto Bebb

Member of Parliament for Aberconwy / Aelod Seneddol Aberconwy

My reply.

From:

Sent: 26 February 2013 19:40

To: BEBB, Guto

Subject: RE: Parliamentary matters 27th February 2013

Dear Guto,

YOur quote: "If you are an owner-occupier, you may be able to get help with your mortgage interest through Income Support, income-based Jobseeker’s Allowance, income-related Employment and Support Allowance (ESA) or Pension Credit."

The help whilst on these benefits are from housing benefit what it pays for is immaterial in my view. They are still under occupying and claiming housing benefit but are exempt from the cuts in regards to the bedroom tax. Is this fair then?

Let us not forget Sir, that by your own policies you are trying to cut the housing benefit bill as well as dealing with under occupancy.

Quote: "In the same way the under occupancy rules have applied to those renting from private landlords for years with no complaints from you or others who are now complaining."

Having never been in the position financially to rent a private house I only go by knowing that until now there has never been such civil unrest both by those in private or the social sector housing.

I have looked into the Local Housing Allowance and I can apply for £158 per week to go private for a one bedroomed property. By your own policies I will be entitled to that amount. I can see two problems with this.

A) I can see that there is £31 increase difference that I will be claiming from Housing Benefit whilst unable to work if I go into private accommodation that fits the criteria you have set out.

B) When I return to work I will not be able to afford this rent totally so will have to claim help whilst on a low income.

C) There are no properties in this area that will take are within that budget that will take DSS or accept the Guaranteed Deposit scheme available.

D) If I stay here I will have to pay the government £19.40 out of my employment and support allowance leaving me with £51.60 to live on per week.

E) I will get into debt with utilities, cut down on food which will affect my health and avoid shopping and travelling. This brings nothing to the government.

F) There is no mention of encouraging those owner occupiers to rent out their rooms or spare rooms. There is also no sign of encouraging any home owner to consider this if over crowding was really a problem and this is priority to the government.

Those in private rented accommodation and are now affected by the bedroom tax are all complaining of the same things. Lack of money due to disability or illness and unable to work. Loss of security. Fear of eviction and poverty. Fear of loosing touch with families and their social network. Fear for moving and loosing jobs because they might have to go to a whole new area. I might have to myself. Fear of their children having to move schools. Fear of people having to give up pets. Fear of the disabled loosing room that is valuable to their family needs, so have been suitable for their needs also. Fear of break down of marriage because of the stress. Fear of children not being able to see the separated parents and stay over.

That is why we are all complaining about it now.

Quote "Whilst the changes are difficult they simply provide a level playing field for those renting privately and there is no issue in terms of excluding owner occupiers as you claim since you cannot be excluded from a benefit that you dot qualify for."

Exactly. They do not qualify because they are exempt from the tax you are imposing on those who need it most.

To add to the misery, although your party policy is 'we are all in it together' , I see that in April there will also be a tax cut for the rich. At a time we need the money. At a time we should ALL be having to pay one way or another. I might remind you that Lord Freud himself has two houses and 11 or so spare rooms.

Is it about over crowding or is it about cutting costs?

Dawn Tibble

His reply:

From: guto.bebb.mp@parliament.uk<mailto:guto.bebb.mp@parliament.uk>

To:

Subject: RE: Parliamentary matters 27th February 2013

Date: Tue, 26 Feb 2013 19:46:45 +0000

Dear Dawn,

So you were wrong.

Those in private rented accommodation are not ‘now’ affected so you keep making silly claims.

You show your true colours with your envy of the financial position of Lord Freud and you simply do not understand that HB has gone from £12bn to £23bn in ten years. The aim of the policies we are introducing are to control a spiralling budget – the least we should do.

Finally it is apparent to me that somebody with your ability to roll out a detailed (if incorrect) argument within twenty minutes should be able to find a job very quickly.

Yours,

Guto Bebb

Member of Parliament for Aberconwy / Aelod Seneddol Aberconwy

my reply:

From:

Sent: 27 February 2013 11:16

To: BEBB, Guto

Subject: RE: Parliamentary matters 27th February 2013

Dear Gutto

They are not affected by the bedroom tax even though they are entitled to housing benefit whilst they are on other benefits. The help with their interest payments comes from The housing benefit pot.

I also ask why there has been such a huge rise in housing benefit in the last ten years. Now could that be because of immigration, could it be that more people are now disabled or unable to work, could it be the high rising cost of housing, could it be that employers are now siding with employing part time workers rather than full time workers, could it be that the minimum wage is not a living wage so low paid workers are now forced to top up by claiming housing benefit?

You have no argument or answers and reply with insults. It has become apparent that the subject of owner occupiers has hit a nerve.

I do my research and gain information from document approved by parliament from the DWP. You have been ill informed if you believe the bedroom tax is either fair or is going to save money from the welfare budget.

Do you claim expenses by the way? I think that you do.

If you claim is correct that I should not have a problem getting a job, can you explain why after trying for a year of applications for an array of different jobs I still had no luck with employment which lead me to having to start my own business. Which is local and will only continue if I can continue to stay in my property.

You have not been able to answer any of my questions so far and you are laughable and this is a typical response expected from a closed minded arrogant conservative.

The fact I pointed out facts regarding Lord Freud is nothing to do with envy. How ridiculous to even mention it. Your attitude at best is immature and of schoolboy mentality.

My points have been made quite clear on fairness, the inability for people to meet the needs to survive and how financially this whole scheme is false economy.

There is obviously no point in continuing with somebody who has little ability of listening and understanding and answering in anyway other than insults and assumptions.

YOur sincerely

Dawn Tibble

His reply:

From: guto.bebb.mp@parliament.uk

To:

Subject: RE: Parliamentary matters 27th February 2013

Date: Wed, 27 Feb 2013 11:18:54 +0000

Dear Dawn,

I have not insulted you once.

Your e-mail is based on factual inaccuracies and throwing dirt at others. There is no housing benefit for owner occupiers and you have not been able to prove your case. As a result you have now reverted to the only option left to you which is name calling and ill considered comments about expenses.

By the way, if you are self-employed how do you find the time to send such long winded rants to an MP?

Yours sincerely,

Guto Bebb

Member of Parliament for Aberconwy

My reply:

-------- Original message --------

Subject: RE: Parliamentary matters 27th February 2013

From:

To: "BEBB, Guto" <guto.bebb.mp@parliament.uk>

CC:

Dear Guto,

I disagree.

By the way if you are an MP how do you find the time to send such idiotic responses.

I have known owner occupiers who have in fact been awarded housing benefits when on Jobseekers allowance. The DWP document clearly states that owner occupiers are included in the statistics gathered in regards to housing benefit and over crowding. Please do your homework before attacking me. I speak for many others.

Your emails have been forwarded to the complaints compartment for further instruction. Our conversation has now ended.

your sincerely

Dawn Tibble

His reply:

From: guto.bebb.mp@parliament.uk

To:

Subject: RE: Parliamentary matters 27th February 2013

Date: Wed, 27 Feb 2013 11:57:50 +0000

Dawn,

You are as inept as you are rude.

You do not understand the issue and yet send me reams of text. My responses have been short and to the point.

By all means get back to me when you understand HB but until then stop wasting your time.

Yours,

Guto Bebb

Sent from Samsung Mobile

My reply

Dear Guto

You are just unbelievable in your idiotic responses. I emailed a lot of MPs. You have returned your answers by Text. I have every right to respond.

Let me put it this way.

The home owners are helped with their mortgage interest up to the value of £200,000 and cost the government over £400 million per year.

Lord Freud has decided that this is a pot that can remain the same. Whilst those struggling on low incomes, are disabled or ill have the threat of loosing their houses through the bedroom tax implemented by Lord Freud.

My point has been made that if we are all in it together we should all be in it together. The policy is unjust, unfair and unworkable. My point has been made again.

I am finished with debating with someone who gets defensive and fails to read my whole emails. I could also have mentioned your £12K expenses claims but you will attack me again with assumptions that I am envious.

It has been enlightening to have corresponded with you.

best wishes

Dawn Tibble

His reply:

From: guto.bebb.mp@parliament.uk

To:

Subject: RE: Parliamentary matters 27th February 2013

Date: Wed, 27 Feb 2013 12:20:35 +0000

Dear Dawn,

So my crime is to engage?

Rude and silly again but as I say, until you understand the issue all you can do is throw insults.

Yours,

Guto Bebb

Sent from Samsung Mobile

Channel 4 news did a feature this evening on the impact of this tax on the disabled.

http://www.channel4.com/news/bedroom-tax-is-appalling-says-paediatrician

and this link for more info

Meanwhile, in a parallel universe, RBS (that's the bank which is 82% owned by the taxpayer) is paying out £600m in bonuses despite having made a loss of £5.2bn.

http://www.guardian.co.uk/society/2013/mar/05/bedroom-tax-judge-ministers-review

A judge has given the DWP and IDS 14days to reply

NATIONAL HOUSING FEDERATION

Thousands of low-income families across the South West will be forced to pay more rent or move out of their homes when the bedroom tax comes in on 1 April, according to the National Housing Federation.

Figures released today by the Federation claim that under the Government's new bedroom tax, 30,000 people in the South West will lose an average of £584 a year in Housing Benefit if they have one 'spare' bedroom in their council or housing association home and £1,043 a year if they have two or more.

The Federation claims about 18,900 of those affected are disabled and if the Government's Discretionary Housing Payments fund was shared equally among disabled people hit by the tax they would each receive as little as £1.71 a week from the Government through Discretionary Housing Payments to cover the shortfall - compared to the average £14 a week loss in housing benefit.

The bedroom tax affects all working-age housing benefit claimants who are deemed to have one or more bedrooms in their council or housing association home.

This includes separated parents who share the care of their children, families where young children have a small bedroom each, foster carers, and disabled people who have their home specially adapted for their needs.

Catherine Brabner, South West lead manager for the National Housing Federation said: "The Government's bedroom tax is flawed and will unfairly penalise thousands of people in the South West who have lived in their homes for years, raised families and contributed to their communities.

"The 'one-size-fits-all' approach takes no account of disabled people's adapted homes, of foster parents who need rooms to take children in, or of parents sharing custody who will lose the room for their child at weekends.

"In most areas, there just aren't enough smaller af fordable homes for these families to move into to avoid the tax. Many people will find themselves having to move into more expensive privately rented properties - adding to the overall housing benefit bill.

"The bedroom tax shows just how detached Ministers are from the lives of families who will be hit. The high housing benefit bill is because there are not enough affordable homes, so the best way to cut the bill is to build more."

The National Housing Federation is calling on the Government to repeal this ill-conceived policy, but at the very least right now it must exempt disabled and other vulnerable people from these cuts before it comes into effect on 1 April.