Beyond Dawlish

A Story of Financial Awakening

Sarah thought she had her finances under control. Good job. Decent savings. Comfortable apartment. Life seemed fine—until an unexpected medical bill hit. Her savings vanished overnight. Reality hit hard. She realized she had no real plan. Like many, she was living paycheck to paycheck, assuming everything would work out. That wake-up call changed everything. She started seeking financial advice, taking control of her money, and working towards financial stability. Her story isn’t unique. The good news? Anyone can take steps to secure their future.

Let’s talk about how to do that. This guide breaks down practical steps, backed by real stats and expert financial advice. Learn how to budget, invest, and prepare for the unexpected. Get ready to take charge of your money and build confidence in your future.

Why Financial Stability Matters

A 2023 Federal Reserve report found that 37% of Americans couldn’t handle an unexpected $400 expense. That’s a big problem. It highlights the need for smarter money management. Financial stability isn’t just about being rich. It’s about feeling secure—knowing that if life throws a curveball, you can handle it.

Step 1: Build a Strong Budget

A solid budget is the foundation of financial success. Yet, a 2022 U.S. Bank survey revealed that only 41% of Americans use one. Those who do? They feel more in control.

How to Create a Budget That Works

-

Track Your Income and Expenses – Know where your money goes. Categorize expenses into needs, wants, and savings.

-

Use the 50/30/20 Rule – Spend 50% on needs, 30% on wants, and save 20%.

-

Adjust and Monitor – Use apps like Mint or YNAB to stay on track.

Step 2: Build an Emergency Fund

Bankrate found that 57% of Americans can’t cover a $1,000 emergency. That’s why you need an emergency fund.

How Much Should You Save?

-

Start with $1,000. Then aim for three to six months’ worth of expenses.

-

Keep it in a high-yield savings account for easy access.

Step 3: Reduce and Eliminate Debt

Debt is a major roadblock to financial stability. A 2023 Experian report states the average American household has $7,951 in credit card debt.

Strategies for Debt Reduction

-

Debt Snowball Method – Pay off the smallest debt first. Gain momentum as you go.

-

Debt Avalanche Method – Tackle high-interest debts first. Save money in the long run.

-

Negotiate Lower Rates – Call lenders and ask for better terms. It works more often than you think.

Step 4: Invest for the Future

Investing builds long-term financial stability. Fidelity found that those who invest early and consistently grow wealth significantly over time.

Where to Invest

-

401(k) or IRA – Free money if your employer matches. Don’t leave it on the table.

-

Stocks and Bonds – A mix of both helps balance risk and reward.

-

Real Estate – Property can provide passive income and long-term value.

Step 5: Plan for Retirement

The U.S. Bureau of Labor Statistics reports the average retirement age is 64 for men, 62 for women. But many aren’t financially ready.

Retirement Planning Tips

-

Start Early – The sooner, the better. Time is your best friend.

-

Maximize Employer Contributions – At least contribute enough to get the full company match.

-

Diversify Your Retirement Accounts – Use a mix of Roth IRAs, 401(k)s, and pension plans.

Step 6: Protect Your Financial Future

Insurance is often ignored but crucial for financial stability. It protects your savings from unexpected disasters.

Must-Have Insurance

-

Health Insurance – Medical emergencies can drain savings fast.

-

Life Insurance – Ensures your family is financially secure.

-

Disability Insurance – Covers you if you’re unable to work.

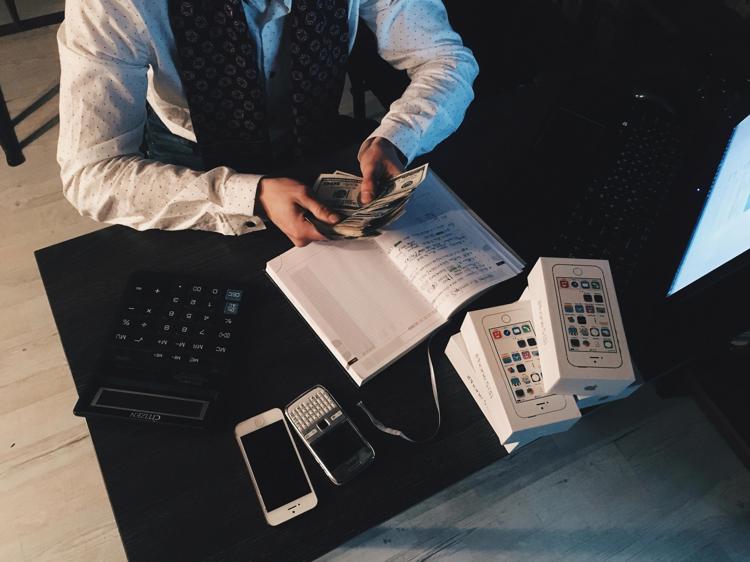

Step 7: Get Expert Financial Advice

A Certified Financial Planner (CFP) can help you make smarter money moves. Studies show that people who get professional financial advice build up to three times more wealth.

How to Pick the Right Financial Advisor

-

Choose a fiduciary who works in your best interest.

-

Look for credentials like CFP or CFA.

-

Compare fees before committing.

FAQs

1. What’s the first step toward financial stability?

Start with a budget, track expenses, and build an emergency fund.

2. How much should I save for emergencies?

At least three to six months of living expenses.

3. Is it too late to start investing in my 40s?

Nope! It’s never too late. Just focus on maximizing retirement contributions and diversifying investments.

4. What’s the best way to pay off debt?

Try the debt snowball (smallest first) or avalanche (highest interest first) method.

5. How do I find a good financial advisor?

Look for certified pros, read reviews, and compare costs.

Conclusion: Take Action Now

Sarah’s story proves that financial security isn’t about luck. It’s about planning and taking action. Follow this financial advice and build smart money habits. Financial stability isn’t a dream—it’s within reach. Start today. Your future self will thank you.