Summary:

- The global automotive antifreeze market size reached USD 4.4 Billion in 2024.

- The market is expected to reach USD 6.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033.

- Asia Pacific leads the market, accounting for the largest automotive antifreeze market share.

- Ethylene glycol holds the majority of the market share in the fluid type segment.

- Organic acid technology (OAT) dominates the automotive antifreeze industry.

- Commercial vehicle is the leading segment in the market, driven by the increasing demand for heavy-duty vehicles in sectors like transportation and construction.

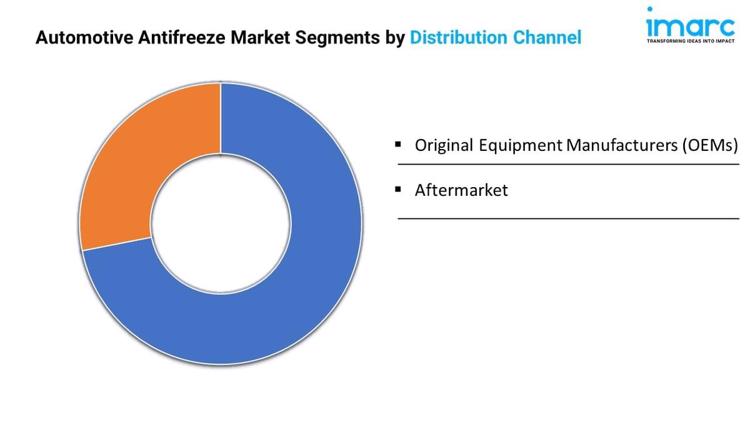

- Aftermarket represents the biggest distribution channel segment.

- Regulatory emphasis on environmentally compliant coolants is a primary driver of the automotive antifreeze market.

- Technological advancements and aftermarket services and maintenance culture are reshaping the automotive antifreeze market.

Request for a sample copy of this report: https://www.imarcgroup.com/automotive-antifreeze-market/requestsample

Industry Trends and Drivers:

- Technological advancements in antifreeze formulations:

New developments in the composition of antifreezes are improving the performance, reliability and eco-friendliness of these solutions. Manufacturers are leaning towards new materials such as OAT and HOAT that are more effective in protecting against corrosion and last longer than conventional antifreezes. These technological improvements are crucial in meeting the capabilities required by contemporary engines, mainly because they require better cooling as temperatures rise. In addition, hybrid and electric vehicles (EVs) are on the rise, and this factor alone is fuelling a race for antifreeze solutions that can point to the right thermal management systems for these modern generation cars.

- Regulatory emphasis on environmentally compliant coolants:

Each country now implements environmental regulations to decrease the environmental impact of automobile products. Slow changes in antifreeze solutions towards less toxic substances alongside toxicity reduction policies are now driving governments to establish mandatory regulations for eco-friendly antifreeze solutions. Governmental regulations are pushing manufacturers toward developing propylene glycol antifreeze which presents less environmental hazards than ethylene glycol products. Businesses face environmental standards which demand environmentally sound product manufacture for the reduction of dangerous chemical emissions and hazardous waste outputs. Automotive antifreeze manufacturers conduct research to create new formulas that enhance engine efficiency while fulfilling environmental requirements that recently entered the automotive field.

- Aftermarket services and maintenance culture:

Owners of vehicles exhibit better awareness about performing regular maintenance because they understand how coolant replacement and system clearing improves both their car's durability and performance level. Vehicle owners gain more knowledge because service information exists readily online and there is an expanding network of maintenance facilities providing specialized services. The market growth happens because vehicle owners need to replace fluids along with antifreeze as they maintain their older vehicles for improved efficiency and reduced repair expenses. The automotive aftermarket segment expansion creates a stable market demand for antifreeze products alongside innovations in product developments to fulfill advanced requirements of modern vehicles.

Automotive Antifreeze Market Report Segmentation:

Breakup By Fluid Type:

- Ethylene Glycol

- Propylene Glycol

- Glycerine

Ethylene glycol exhibits a clear dominance in the market accredited to its effective heat transfer properties, low freezing point, and widespread availability.

Breakup By Technology:

- Inorganic Additive Technology (IAT)

- Organic Acid Technology (OAT)

- Hybrid Organic Acid Technology (HOAT)

Organic acid technology (OAT) represents the largest segment, as it offers extended life for the coolant, better corrosion protection, and compatibility with various engine components.

Breakup By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Construction Vehicle

Commercial vehicle holds the biggest market share attributed to the growing demand for heavy-duty vehicles in sectors like transportation and construction.

Breakup By Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Aftermarket accounts for the majority of the market share due to the continuous need for coolant replacement and maintenance in existing vehicles.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market owing to the presence of a large automotive manufacturing base and the rising vehicle ownership in the region.

Top Automotive Antifreeze Market Leaders:

The automotive antifreeze market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- AMSOIL Inc.

- BP p.l.c.

- Chevron Corporation

- Cummins Inc.

- ExxonMobil Corporation

- Fuchs Petrolub SE

- Halfords Group PLC

- Motul S.A

- Prestone Products Corporation

- Recochem Inc.

- Shell plc

- TotalEnergies SE

- Valvoline Inc.

- VOLTRONIC GmbH

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) 91 120 433 0800

United States: 1-631-791-1145