Beyond Dawlish

The Registro Federal de Contribuyentes (RFC) is a vital requirement for anyone wishing to operate legally in Mexico. This essential guide provides in-depth information about the RFC, its significance, the application process, and the advantages it offers to individuals and businesses alike.

Understanding the RFC

The RFC (Federal Taxpayers Registry) is a unique identification number assigned to individuals and legal entities engaged in economic activities in Mexico. This identification is crucial for tax compliance, enabling the Mexican government to effectively monitor and collect taxes from its taxpayers. Understanding cómo calcular un RFC accurately is an important aspect of meeting legal obligations.

Categories of RFC

There are two primary categories of RFC that individuals and businesses should be aware of:

- RFC for Individuals: Issued to Mexican citizens and foreign residents who conduct business activities in the country.

- RFC for Legal Entities: Assigned to companies, organizations, and other legal entities operating in Mexico.

Why the RFC is Important

Obtaining an RFC is essential for several reasons:

- Legal Compliance: The RFC is required for filing taxes, ensuring that individuals and businesses meet their tax obligations.

- Business Transactions: An RFC is necessary for issuing invoices, opening business bank accounts, and entering into legal contracts.

- Government Programs: Many government initiatives and financial incentives require an RFC for eligibility, making it essential for both individuals and businesses.

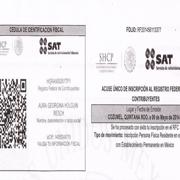

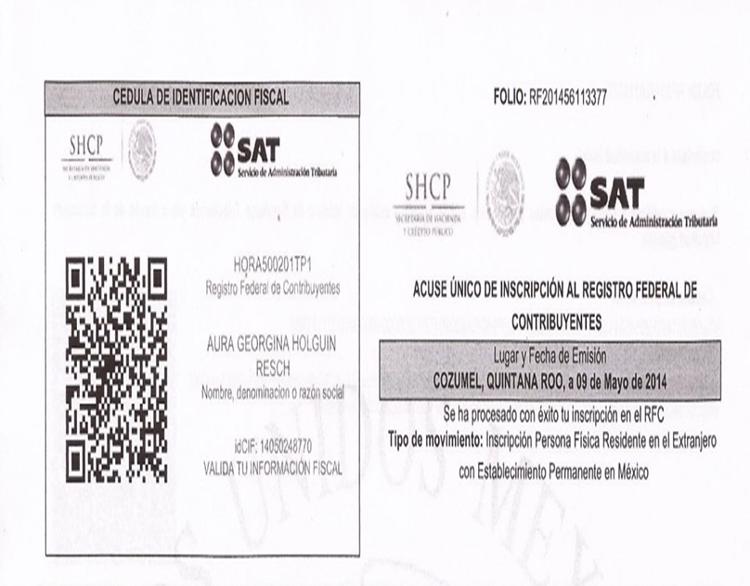

Steps to Obtain an RFC

The process of acquiring an RFC is systematic and straightforward. Follow these steps to ensure a successful application:

- Prepare Required Documentation: Gather necessary documents, including identification, proof of address, and any legal documentation for businesses.

- Fill Out the Application Form: Complete the RFC application form, which can be found online or at designated government offices.

- Submit Your Application: Present the filled-out form along with the required documents to the relevant authority.

- Receive Your RFC: After processing, you will be issued your RFC, allowing you to operate legally in Mexico.

Advantages of Having an RFC

Maintaining a valid RFC provides numerous benefits for both individuals and businesses:

1. Accurate Tax Reporting

A valid RFC ensures taxpayers can report their income and expenses accurately, thereby minimizing the risk of tax evasion and associated penalties.

2. Improved Operational Efficiency

An RFC streamlines invoicing and business transactions, leading to enhanced efficiency in operations.

3. Access to Government Services

A valid RFC allows individuals and businesses to access essential government services, grants, and financial assistance programs.

4. Enhanced Credibility

For businesses, a registered RFC fosters transparency and builds trust with clients, suppliers, and financial institutions.

Conclusion

Understanding the RFC and its importance is critical for anyone engaged in economic activities in Mexico. The RFC not only ensures compliance with tax regulations but also simplifies business operations and opens doors to various government services. By obtaining and maintaining a valid RFC, individuals and businesses can navigate the Mexican economic landscape with confidence.

Final Thoughts

Whether you are a freelancer starting your career or a business owner looking to establish a foothold in Mexico, securing an RFC is a fundamental step toward achieving your goals. Taking the necessary actions to comply with this essential requirement will lay the groundwork for a successful and legally compliant operation.

Call to Action

Begin your journey today by gathering the required documents and familiarizing yourself with the RFC application process, ensuring your operations in Mexico are both legal and efficient.